What Is Coin Market Cap and How Does It Work?

🪙 What Is Coin Market Cap and How Does It Work?

Introduction

In the world of cryptocurrency, information is power. Whether you’re an investor, trader, or simply curious about digital currencies, having access to accurate and up-to-date data is essential. This is where Coin Market Cap (CMC) comes in — one of the most trusted platforms for tracking the performance, price, and market trends of cryptocurrencies.

Since its launch in 2013, Coin Market Cap has become the go-to data source for millions of crypto enthusiasts across the globe. But what exactly is Coin Market Cap, and how does it work? Let’s break it down.

What Is Coin Market Cap?

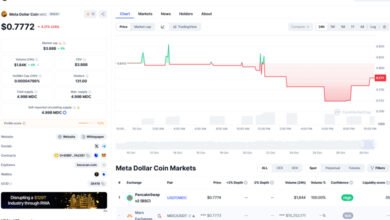

Coin Market Cap is a cryptocurrency data aggregator that provides real-time information about digital assets. It tracks thousands of cryptocurrencies, offering detailed metrics such as:

Essentially, Coin Market Cap acts as a bridge between investors and the crypto market by organizing complex blockchain data into easy-to-read charts and rankings.

A Brief History

Coin Market Cap was founded in 2013 by Brandon Chez, who aimed to create a reliable and transparent source of cryptocurrency data. Over time, the platform gained massive popularity for its neutrality — it simply listed data without promoting specific coins.

In 2020, Coin Market Cap was acquired by Binance, one of the world’s largest cryptocurrency exchanges. Despite the acquisition, Coin Market Cap continues to operate independently, maintaining its commitment to data accuracy and transparency.

How Coin Market Cap Works

1. Data Aggregation

Coin Market Cap gathers data from hundreds of crypto exchanges around the world. These exchanges provide real-time information about:

-

Trading pairs (like BTC/USDT or ETH/USD)

-

Market prices

-

Trade volumes

-

Liquidity levels

CMC then aggregates and verifies this data using sophisticated algorithms to display an average, fair-market price for each cryptocurrency.

2. Price Calculation

The price displayed for a cryptocurrency on Coin Market Cap isn’t taken from one exchange alone. Instead, it’s a weighted average — calculated from multiple exchanges, adjusted by volume and liquidity.

This ensures that no single exchange can manipulate a coin’s displayed value, making Coin Market Cap data more balanced and reliable.

3. Market Capitalization

Market cap is a key ranking metric on Coin Market Cap.

It’s calculated as:

Market Cap = Current Price × Circulating Supply

This number gives users an idea of the coin’s overall market value and helps compare different cryptocurrencies’ sizes and dominance.

4. Exchange Rankings

Coin Market Cap also ranks crypto exchanges based on several factors:

-

Trading volume (spot and derivatives)

-

Liquidity score

-

Web traffic

-

Regulatory compliance

-

Transparency

These rankings help traders choose reliable exchanges and avoid potentially risky or unregulated platforms.

5. Additional Tools and Features

Coin Market Cap has evolved far beyond simple price tracking. Some of its popular tools include:

-

Portfolio Tracker – Manage and monitor your crypto investments.

-

Watchlist – Keep track of your favorite coins.

-

Learn & Earn – Educational programs that reward users in crypto.

-

ICO Calendar – Stay informed about upcoming token launches.

-

Community Insights – Explore trending coins and market sentiment.

Why Coin Market Cap Is Important

-

Transparency: It provides unbiased data, helping users make informed investment decisions.

-

Comprehensive Coverage: Tracks over 25,000+ cryptocurrencies and 600+ exchanges worldwide.

-

Historical Data: Investors can analyze long-term trends and price patterns.

-

Free Access: All this information is available for free, making it accessible to everyone — from beginners to experts.