Market Forecast 2025: Price Predictions and Growth Factors for Coin

Price Predictions and Growth Factors for Coin

Market Forecast 2025: Price Predictions and Growth Factors for Coin

Why Coin Is Positioned for the Next Bull Run

In the ever-shifting landscape of cryptocurrency, timing and preparation often matter as much as underlying technology. The project we’ll call Coin appears to be well-positioned for the next major market-upswing. Here’s why:

1. Macro-Tailwinds

-

As institutional adoption continues to rise, more capital flows into crypto; once the “risk-on” cycle triggers again, altcoins and younger projects often benefit disproportionately.

-

Regulatory clarity (in some jurisdictions) is improving, reducing one major overhang for the space.

-

The next bull run tends to be driven by new infrastructure, new use cases, and network effects; if Coin is ready with product and ecosystem, it stands to capture upside.

2. Project-Specific Strengths

-

If the tokenomics are favorable (reasonable total supply, strong allocation, clear burn/lock-up mechanisms), then Coin may benefit from scarcity + demand.

-

If the team has set up upcoming milestones (major listings, partnerships, real-world utility) then the market may increasingly price that in.

-

If the coin is now listed or coming to large wallets & apps (for example, support in large wallets or exchanges), that increases visibility and liquidity, a key enabler for a bull-run.

3. Early Mover Advantage + Market Psychology

-

When the market senses a project is gearing for growth, early accumulation tends to happen — smart investors often get in before large‐scale listings or hype.

-

Once a coin begins to break out, momentum can build quickly as FOMO (“fear of missing out”) kicks in. If Coin is among the more promising names in its cohort, it could ride that wave.

4. Relative Undervaluation

-

If the project is under-the-radar (i.e., smaller market cap than peers, fewer listings) yet has comparable vision or tech, there may be outsized upside if it executes.

-

If traditional assets (stocks, bonds) are showing signs of exhaustion, money may flow into crypto in search of higher returns—projects like Coin may benefit disproportionately.

5. Listing & Ecosystem Catalysts

-

A major listing on a large exchange is often a trigger in bull cycles: more users + more liquidity = higher price potential.

-

If Coin is supported by major wallets (e.g., Trust Wallet) or integrated into DeFi/real-world applications, that gives it the infrastructure for broad adoption and demand.

All of those factors combine to make the case that Coin is poised for the next bull run — subject, of course, to execution and market conditions.

How Early Investors Benefit From Holding Coin

Investing early in a crypto project (like Coin) carries risk, but it also offers unique benefits that don’t exist in many traditional asset classes.

1. Magnified Upside Potential

-

Early investors gain exposure before the mainstream gets in. If Coin executes well, the upside can be many × initial cost.

-

Because the market may undervalue the project initially (low awareness, low liquidity), early holders can benefit from a ‘re-rating’ when things turn.

2. Lock-ups and Vesting Mechanisms

-

Good projects often have token lock-ups for team/advisors, meaning large dumps are less likely in the near term. Early investors can hold through that period and benefit once the locks expire and liquidity opens up.

-

If Coin has a fixed or deflationary supply model, early holders benefit from scarcity as adoption grows.

3. Compound Effect of Time

-

The longer you hold (assuming project viability), the more time the ecosystem has to grow: partnerships matured, network effects built, utility realised. This may compound the value of Coin.

-

Early accumulation allows for greater flexibility: you can hold through volatility and capture the full run-up.

4. Lower Entry Price & Risk/Reward Asymmetry

-

Early investors may secure a lower cost basis compared to later entrants when hype is high. That improves the asymmetric risk/reward (i.e., smaller downside, larger potential upside).

-

If Coin’s fundamentals hold, the early phase may offer more time to evaluate progress before large institutional money drives the price.

5. Alignment with Project Growth

-

By holding from early on, you essentially become part of the ecosystem’s story: as the project hits milestones, you ride along.

-

If the project distributes value (staking rewards, governance rights, etc.), early holders may enjoy additional perks beyond mere price appreciation.

In short, early investors in Coin stand to benefit from timing, growth, and structural advantages that later-stage entrants may miss.

Long-Term Investment Strategy: Where Coin Fits in a Balanced Portfolio

Putting Coin in a broader investment strategy requires discipline, balance, and clarity about risk. Here’s how to think about it.

1. Portfolio Role

-

Crypto assets like Coin generally fall into the growth/risk-enhanced bucket of a portfolio — they’re not stable income producers like bonds, nor typically low-volatility stores like blue-chip stocks.

-

As such, allocate accordingly: only a portion of the total portfolio should be in high-risk crypto, allowing for sufficient upside while preserving capital.

-

Maintain diversification: Holding Coin should accompany other assets (equities, fixed income, other cryptocurrencies) to spread risk.

2. Time Horizon and Holding Strategy

-

For long-term (5 + years) investors: Coin can be held as a strategic bet on crypto adoption and technological disruption.

-

Set specific milestones (e.g., listing on major exchange, achieving user-growth targets, ecosystem expansion) and review at those points.

-

Use dollar-cost averaging when entering — avoid timing the bottom exactly, which is often impossible.

3. Risk Management

-

Non-correlation is a myth sometimes: crypto often moves with broader risk sentiment. Allocate only what you’re comfortable losing.

-

Have exit strategies: Decide upfront what triggers a partial or full exit (e.g., project failing to deliver, regulatory crackdown, fundamental change).

-

Keep an eye on project governance, tokenomics, dilution risk, and competitor threats.

4. Tilted Towards Growth, Not Stability

-

Recognize that holding Coin is less about steady dividends and more about capturing growth potential.

-

Accept the possibility of major drawdowns; plan psychologically and financially for volatility.

-

Use it as a smaller but meaningful position in your portfolio, not your entire portfolio.

5. Monitoring and Rebalancing

-

Periodically review progress: Has Coin hit promised milestones? Has network adoption increased? Are tokenomics still intact?

-

Rebalance: If Coin’s allocation grows too large relative to target due to appreciation, rebalance to lock in gains and reduce concentration risk.

-

Maintain discipline to not chase further risk if Coin has already achieved high valuation — the growth stage may shift into a maintenance stage where risk/reward changes.

In essence: treat Coin as a high-conviction growth asset, allocated in a balanced portfolio with clear risk parameters and active monitoring.

The Growth Potential of Coin Compared to Traditional Assets

Why might a project like Coin offer growth potential that traditional assets (stocks, bonds, real-estate) struggle to match?

1. Scale & Innovation Leap

-

Traditional assets often grow at incremental rates (e.g., 6-10 % annual returns for stocks, lower for bonds). Crypto projects can multiply by many times if they capture new markets or become platforms of value.

-

A successful crypto project can scale globally at internet speed, whereas many traditional business models face geographic/regulatory limits.

2. Early Market Inefficiencies

-

Traditional markets are relatively efficient: information flows, valuations are well scrutinized. Many crypto projects are still under-analyzed, meaning smart early investments can find latent value.

-

If Coin is early in its lifecycle, there’s more upside potential than an established FAANG-stock, which may already be significantly priced in.

3. Alternative Growth Drivers

-

Tokenomics, network effects, platform adoption, DeFi integration, governance mechanisms — these are new drivers of value largely unique to crypto.

-

Traditional assets rely on profits, dividends, interest rates; crypto can leverage usage, decentralized finance, token burn/buy-back mechanisms, etc.

4. Portfolio Diversification Benefit

-

Adding a well-chosen crypto asset like Coin can increase expected return for a given level of risk in a diversified portfolio (if the asset is uncorrelated or less correlated with traditional markets).

-

As crypto adoption increases, such assets may play a role similar to “growth startups” in earlier years — high risk, high reward.

5. Time-horizon Advantage

-

Over a long horizon (5-10 + years), the growth potential of a disruptive crypto project can exceed what you’d reasonably expect from many traditional investments — provided you pick the right project and hold through volatility.

Still, it’s important to emphasize: the risks are also significantly higher. While traditional assets have regulatory clarity, predictable cash flows, defined legal frameworks, many crypto projects are experimental, with higher downside. But for those seeking outsized growth and who are comfortable with risk, Coin offers an intriguing growth comparison to traditional investments.

Why Smart Investors Are Accumulating Coin Before Major Listings

Major listings — especially on large exchanges — often act as triggers for increased visibility, liquidity, and price appreciation. Smart investors understand this and position accordingly.

1. “Before the Door Opens” Advantage

-

Prior to listing, trading is often restricted to smaller exchanges or DEXs (decentralized exchanges) — volumes are lower, less competitive. Early accumulation can secure a favorable price.

-

After listing, when major exchange order-books open, influx of new buyers often drives price higher quickly — early accumulation locks in a lower entry before this wave.

2. Liquidity Inflection Point

-

A listing on a prominent exchange usually dramatically increases liquidity: more buyers, sellers, trading pairs, exposure. That can lead to a significant “liquidity premium.”

-

Smart investors anticipate this and build positions ahead of the event, often at lower price/risk.

3. Market Psychology & Hype Cycles

-

Listings are news events — media coverage, retail interest, FOMO all spike. Projects often see percentage gains around listing events.

-

Smart investors buy before the hype, ideally earlier, so they can ride the wave rather than join at the peak.

4. Accumulation Strategy Before Countdown

-

Many projects give hints about upcoming listings (partnerships, exchange talks, audit completions). Investors who track these signals can be ready.

-

Because the listing event has somewhat predictable timing (if the team discloses roadmap), it acts like a “known catalyst” in their investment thesis.

5. Risk Mitigation: Entry Pre-Catalyst

-

Buying before listing means you’re exposed when the risk/reward is more favorable: there is more upside (listing + post-listing momentum) than downside (listing already in price).

-

Once listing is done and hype has peaked, the risk of a price pullback increases — smart investors want to position before the easy “run-up.”

In summary: accumulating Coin well ahead of major listings enables taking advantage of low-visibility entry, liquidity inflection, and momentum build-up — all of which are key to how smart crypto investors structure their trades.

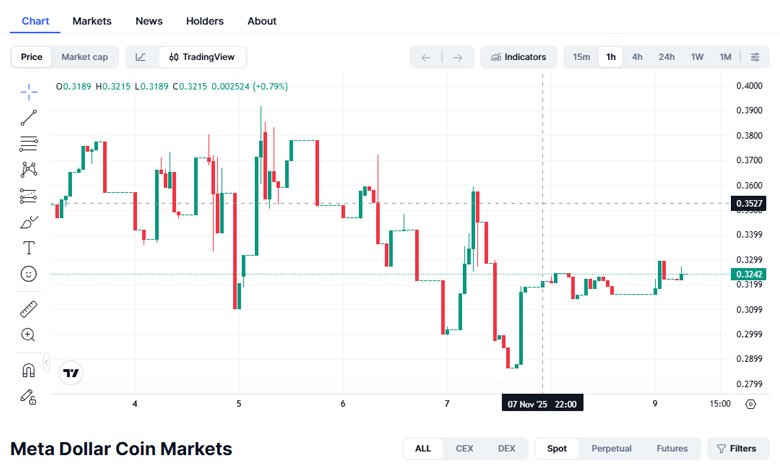

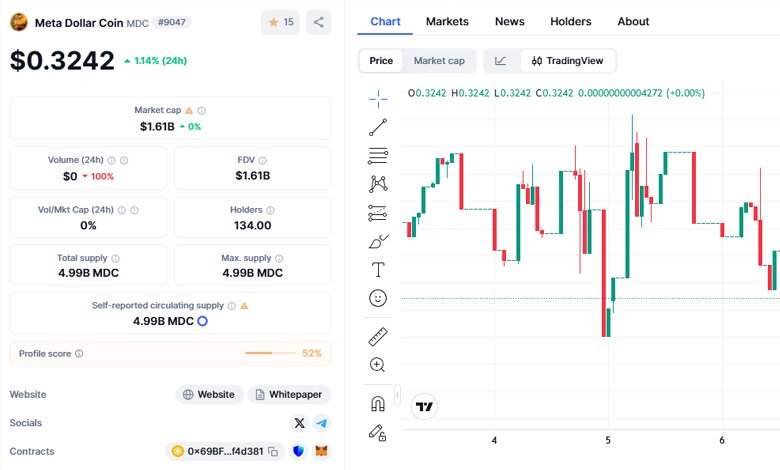

Market Forecast 2025: Price Predictions and Growth Factors for Coin

Let’s delve into what could happen in 2025 for Coin, including possible price scenarios and the growth factors likely to drive it.

1. Key Growth Factors to Monitor

-

Exchange Listings & Liquidity: As discussed, a major listing will be a critical catalyst for volume, price discovery and retail participation.

-

Ecosystem Development: Are there active dApps, users, partners being built on or with Coin? Growth in real usage often correlates with token value.

-

Tokenomics Execution: Mechanisms like burn programs, staking rewards, lock-ups of team tokens, inflation/deflation controls — these matter for scarcity and investor confidence.

-

Regulatory/Compliance Readiness: As regulatory regimes tighten, projects that adhere to compliance (KYC/AML, audits) may attract institutional capital more easily.

-

Macro Market Conditions: The overall crypto bull-cycle status, interest rate environment, risk-appetite in markets — these external factors will impact Coin’s trajectory.

2. Price Scenarios for 2025

While it’s impossible to precisely forecast, let’s define three plausible scenarios for Coin in 2025, assuming reasonable execution:

-

Conservative Scenario: Moderate growth, several months of building ecosystem, one major listing but modest hype → Coin appreciates by, say, 2-3× from current base.

-

Base Scenario: Strong execution, one or more listings, growing user-base, favorable market sentiment → Coin may see 5-10× growth in 2025.

-

Aggressive/Optimistic Scenario: Multiple major listings, breakout ecosystem growth, crypto bull market returns in full force → Coin might see 10-20× or more from its present price (with high risk).

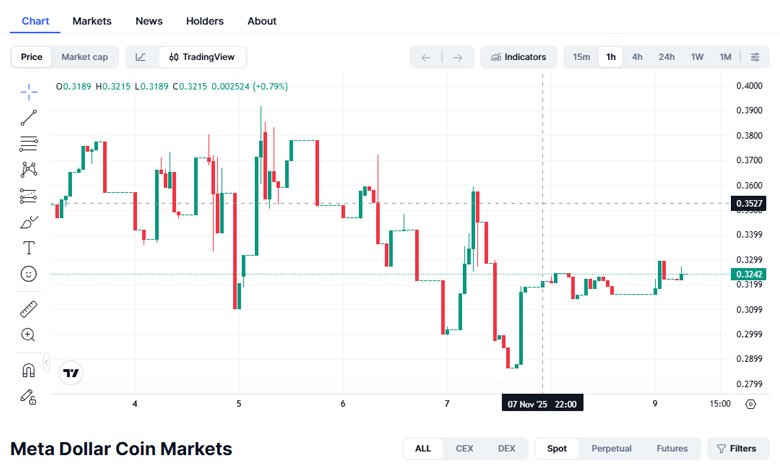

3. Sample Price Estimation

Suppose Coin is currently trading at $0.01 and assuming circulating supply remains stable:

-

In the Conservative Scenario it could reach $0.02-$0.03 by end 2025.

-

In the Base Scenario it might reach $0.05-$0.10.

-

In the Aggressive Scenario it could reach $0.20-$0.30 or higher.

These are illustrative only — actual outcomes will depend heavily on factors above and market conditions.

4. Risks That Could Impede Growth

-

Delayed listings or partnerships.

-

Token inflation or large dilution events (e.g., team tokens unlocked).

-

Market enters a bearish phase (crypto winter).

-

Regulatory setbacks (ban in major market, loss of exchange support).

-

Project execution failures (team drop-out, hacks, poor utility uptake).

5. Final Take

Given the combination of tangible listing catalysts, ecosystem growth potential, and favorable macro conditions, Coin is a candidate for meaningful upside in 2025. If you believe the project will execute and the broader crypto market turns bullish, the risk/reward profile can be compelling.

Conclusion

In sum, Coin offers an interesting investment proposition: it is positioned for the next bull run, early investors stand to benefit from early accumulation, it fits a portion of a growth-oriented portfolio, its growth potential may exceed many traditional assets, and savvy investors are accumulating ahead of major listings. Coupled with disciplined execution and favorable market conditions, 2025 could be a pivotal year for the coin.

Important disclaimer: This is not financial advice. Crypto investments are highly speculative and volatile. Always do your own research (DYOR), understand the project’s fundamentals, tokenomics, team, and risk before investing.