Opinion & EditorialsMarket & Analysis

Technology & Innovation In Crypto

The crypto and blockchain space is continually evolving, driven by several key technologies and innovations aimed at improving scalability, privacy, real-world utility, and interoperability.

Here are the most significant technology and innovation trends in cryptocurrency and blockchain:

Scaling and Efficiency

To overcome the transaction speed and cost limitations of earlier blockchains (like the original Ethereum), innovation is focusing on scaling solutions:

- Layer 2 (L2) Scaling Solutions (Rollups): These technologies execute transactions off the main blockchain (Layer 1) but post the data back to L1 for security.

- Zero-Knowledge Rollups (zk-Rollups): These are a major advancement, using Zero-Knowledge Proofs (ZKPs) to cryptographically prove the validity of off-chain transactions without revealing the data itself. Projects like zkSync and Starknet are prominent.

- Optimistic Rollups: Assume transactions are valid by default and only run a computation if a challenge or “fraud proof” is submitted.

- Modular Blockchain Architecture: This design separates the core functions of a blockchain (execution, consensus, data availability) into specialized layers. This allows for greater specialization and scaling than monolithic chains. Celestia is a key example in data availability.

- Proof-of-Stake (PoS) Advancements: The shift from Proof-of-Work to more energy-efficient PoS consensus mechanisms (like the Ethereum merge) continues to improve sustainability and performance.

Privacy and Cryptography

The need for user privacy and compliance is driving the adoption of sophisticated cryptographic tools:

- Zero-Knowledge Proofs (ZKPs): Beyond scaling, ZKPs are transformative for privacy. They enable a party to prove that a statement is true without revealing the underlying information. This is critical for:

- Identity: Proving age or citizenship without revealing personal documents.

- Compliance: Demonstrating adherence to regulations without exposing sensitive transaction details.

- Confidentiality in Transactions: ZKPs and other privacy-preserving protocols allow transaction details (sender, receiver, amount) to remain private while still being verifiable on the public ledger.

Real-World Asset (RWA) Tokenization and DeFi

The focus is shifting from purely crypto-native assets to bringing tangible value onto the blockchain:

- Real-World Asset (RWA) Tokenization: This involves converting ownership rights of physical and traditional financial assets (like real estate, stocks, bonds, and commodities) into digital tokens on a blockchain. This process increases liquidity, enables fractional ownership, and improves settlement efficiency. BlackRock’s tokenized funds are a significant institutional example.

- Decentralized Finance (DeFi) Evolution: DeFi platforms continue to mature, offering sophisticated financial services (lending, borrowing, trading) without traditional intermediaries. Innovations include:

- Cross-Chain Interoperability: Protocols that allow assets and data to move securely and seamlessly between different blockchain networks.

- Liquid Staking: Allows users to stake assets to secure a network while receiving a “liquid staking token” that can be used in other DeFi applications, maintaining liquidity.

Web3 Infrastructure and Enterprise Adoption

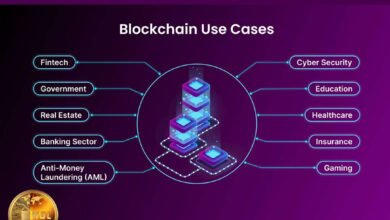

The underlying infrastructure is improving to support mass adoption and enterprise use cases:

- Decentralized Physical Infrastructure Networks (DePIN): These networks use blockchain and crypto tokens to incentivize the community to build and operate real-world physical infrastructure, such as wireless networks, energy grids, and data storage.

- Blockchain and AI Integration: The convergence of AI and blockchain is leading to new use cases like AI-driven smart contracts that can interpret real-world events and automated fraud detection models trained on blockchain data.

- Central Bank Digital Currencies (CBDCs): While not cryptocurrencies in the traditional sense, central banks worldwide are exploring and piloting digital versions of their fiat currencies, often leveraging distributed ledger technology for instant settlement and programmability.

- Enterprise Adoption: Major corporations are increasingly adopting private or permissioned DLT (Distributed Ledger Technology) and integrating public blockchain services for use cases like supply chain management and identity verification.