What is DEX Screener

- DEX Screener is a analytics / tracking platform for decentralized exchanges. It provides real‑time data, charts, token discovery tools, alerts, liquidity metrics, and other insights for tokens and trading pairs across many blockchains.

- It does not custody funds or act as an exchange: it is a tool for monitoring, not for trading.

- The mobile app is highly rated (4.8/5) and supports features like unlimited watchlists, price alerts, and multi‑chain support.

Key Features & Functionality

Here are the main capabilities of DEX Screener:

| Feature | What it provides / how it helps |

|---|---|

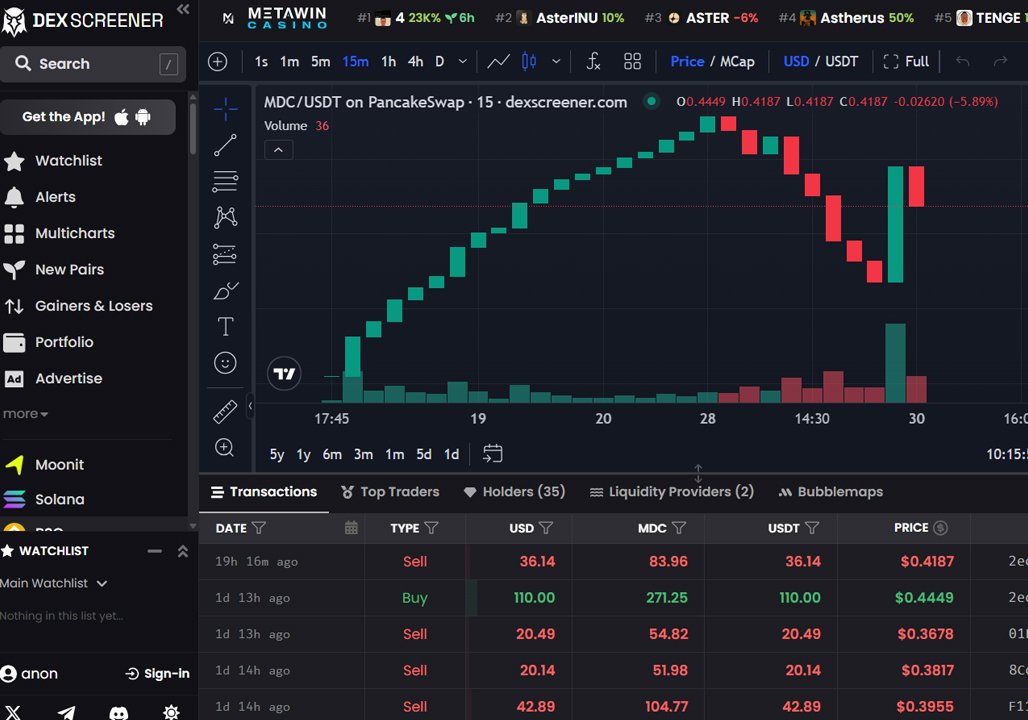

| Real‑time charts & trading data | Live updates of price, volume, trades, order flow, etc. |

| Multi‑chain / multi‑DEX support | Works across Ethereum, BNB Chain, Polygon, Avalanche, Solana, Arbitrum, Optimism, Fantom, Cronos, and more |

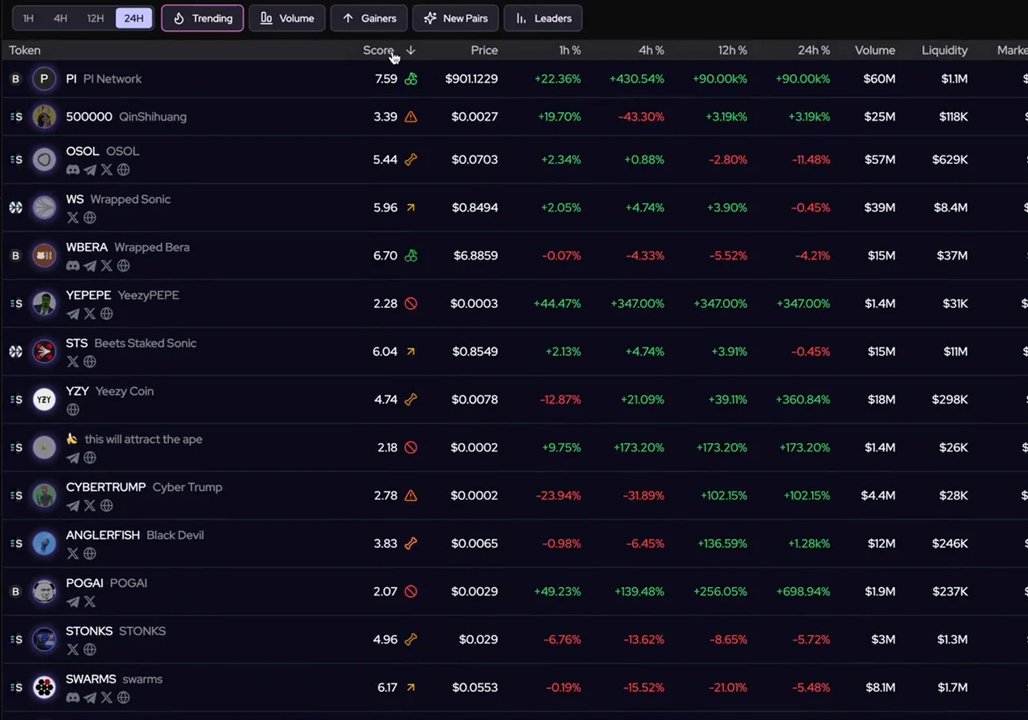

| Token discovery / filtering & trending lists | You can filter for new listings, gainers/losers, set criteria (liquidity, volume, age) to find promising tokens. |

| Alerts & notifications | Set alerts on price moves, liquidity changes, volume spikes, etc. |

| Multi‑charts interface | Ability to view multiple charts side by side / in parallel (up to 16) for comparison and monitoring across tokens. |

| Liquidity & pool analytics | Tracking of liquidity, pool changes, TVL (total value locked), withdrawals/inflows, etc. |

| Whale / large transactions tracking | Monitor large wallets or big moves (“whales”) to anticipate potential market impacts |

| Portfolio / watchlist features | Create watchlists, track tokens across chains, see performance, etc. |

| API & developer access | DEX Screener provides API endpoints so developers can fetch real‑time and historical data for use in bots, dashboards, etc. |

Strengths & What Makes DEX Screener Useful

-

Early token discovery: Many new tokens appear first on DEXes. DEX Screener helps users spot new listings quickly (via “New Pairs,” filters, trending) before they reach larger exchanges.

-

Wide chain & DEX coverage: Because it supports many blockchains and DEXes, it’s useful in cross‑chain trading, arbitrage opportunities, or projects across ecosystems.

-

Granular data & indicators: For more sophisticated traders, the charting tools, technical indicators, liquidity metrics, etc., are valuable.

-

Alerts & real‑time tracking: In fast markets, being notified instantly via custom alerts helps you act quickly.

-

Transparency / on-chain basis: Its data is derived from smart contracts, nodes, DEXs, not just off-chain aggregators, so it’s closer to raw market behavior.

Limitations, Risks & Things to Watch Out For

-

Overload for beginners: The amount of data and features can be overwhelming if you’re new to crypto or trading. Misinterpretation of metrics is a risk.

-

Scam / low quality tokens: Because DEXes allow almost any token to list (with sufficient liquidity), DEX Screener will show tokens that are fraudulent or extremely risky. Always do your own due diligence.

-

Indexing / latency / data gaps: If a blockchain node or DEX is down or delayed, data may lag or be incomplete.

-

No trade execution / custody: You can’t trade directly (in most cases) on DEX Screener — you’d need to go to a DEX or integrate via another interface.

-

Security / wallet connections caution: Some users report being cautious when connecting wallets to DEX Screener–affiliated swap interfaces, especially with newer tokens or DEX integrations.

-

Too early listing issues: Sometimes a token shows up on DEX Screener but isn’t yet tradeable in wallets or via DEX UI due to liquidity or contract propagation delays.

How to Use DEX Screener Effectively

Here are steps / tips for maximizing its usefulness:

-

Choose the blockchain / DEX you want to monitor — filter first to your chain of interest (e.g. Solana, BNB, Ethereum, etc.).

-

Use filters & criteria smartly — set minimum liquidity, volume thresholds, token age, etc., to weed out low‑quality tokens.

-

Watch “new pairs” / trending / gainers — these often show early opportunities, though they carry higher risk.

-

Compare multiple charts / tokens side by side via multicharts to spot patterns, divergences, or relative strength.

-

Set alerts so you don’t miss major moves. For example, price crossing a threshold, liquidity changes, or volume spikes.

-

Track liquidity / inflows / outflows carefully — sudden liquidity withdrawal can hint at rug pulls or exit events.

-

Cross check token info (team, website, audits, contract) — just because it shows on DEX Screener doesn’t mean it’s safe.

-

Use API / automation for bots or custom dashboards if you intend to scale your tracking or trading.

-

Be cautious when connecting your wallet — for risk mitigation, use separate wallets, only connect to trusted interfaces, do not give away seed phrases.

-

Use historical data for backtesting — study how tokens behaved post‑listing to understand patterns and risks.